Finset, an innovative car financing platform, faced a rising challenge: fraud. As the asset financing sector experiences significant fraud growth, Finset needed a robust identity verification solution to protect itself and its stakeholders.

As asset finance fraud continues to escalate in the UK, Finset needed to respond effectively. Misuse of facility cases rose 35% in the first half of 2025, making up almost a quarter of all fraud recorded to the National Fraud Database.

Finset sought a solution that could:

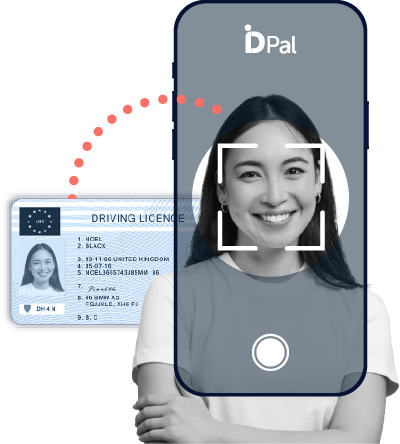

Finset integrated ID-Pal’s identity verification and fraud detection solution via API, focusing on ID-Pal’s ID-Detect. This advanced tool leverages AI to detect fraudulent, AI-generated documents and confirms the presence of a physical document, not a reproduction.

With ID-Pal’s unique blend of biometric, document, and database checks, Finset could now:

Fraud prevention: Preventing over £3 million in fraud in just two years

Customer Experience: Creating a seamless, tailormade onboarding journey for Finset

Compliance & Security: ID-Pal’s platform ensured compliance with AML and KYC

regulations while maintaining zero access to customer data.