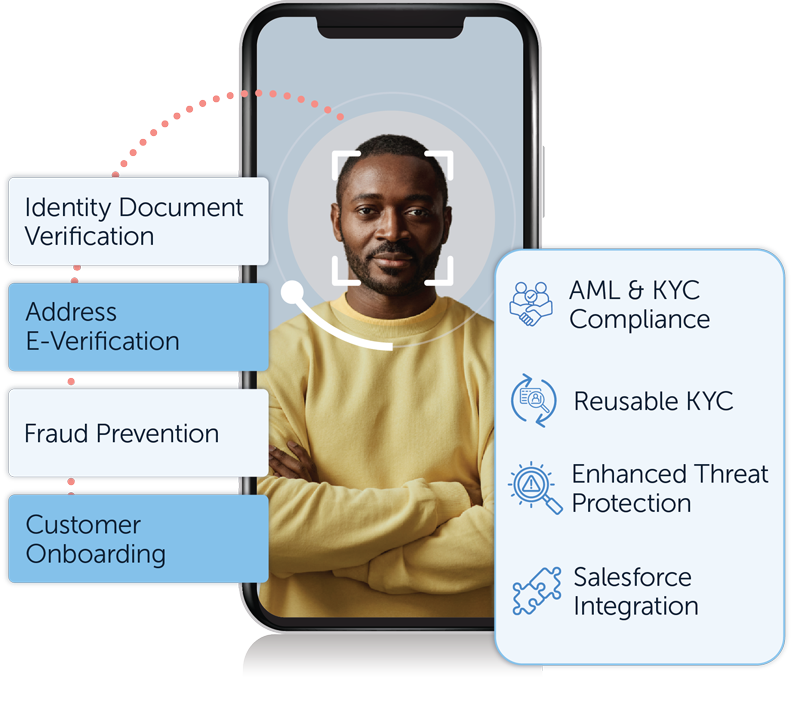

Accurate first-time capture of KYC details combined with multiple Identity and Address checks reduces the burden and resources spent on false positives.

Auto-diversion of high-risk submissions allows the back-office compliance team to allocate resources efficiently.

Smart workflows allow your team to better manage submission volumes, ensuring a timely and effective exceptions handling process.

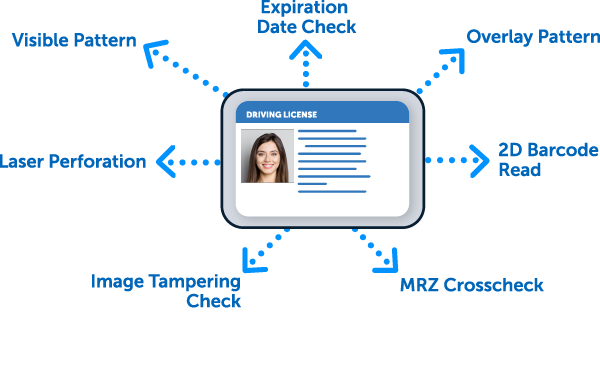

This add-on feature enhances document authenticity and accuracy rates on each submission via checks for document fraud.

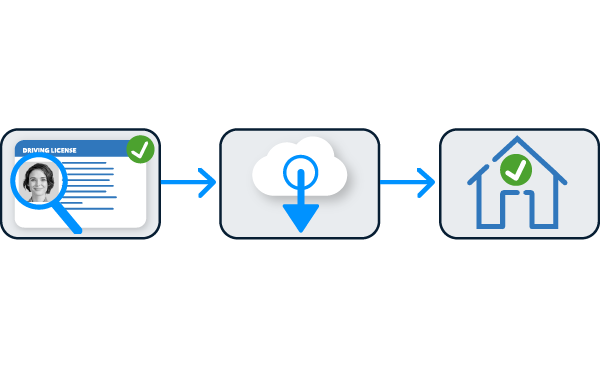

Match against over 160+ trusted data sources to verify an address in real-time, as an additional layer of fraud prevention.

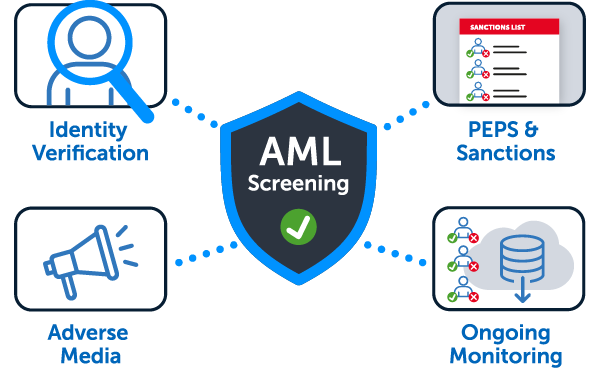

Instantly screen individuals against global sanctions lists. Perform adverse media checks across live sources. Enroll in ongoing checks.

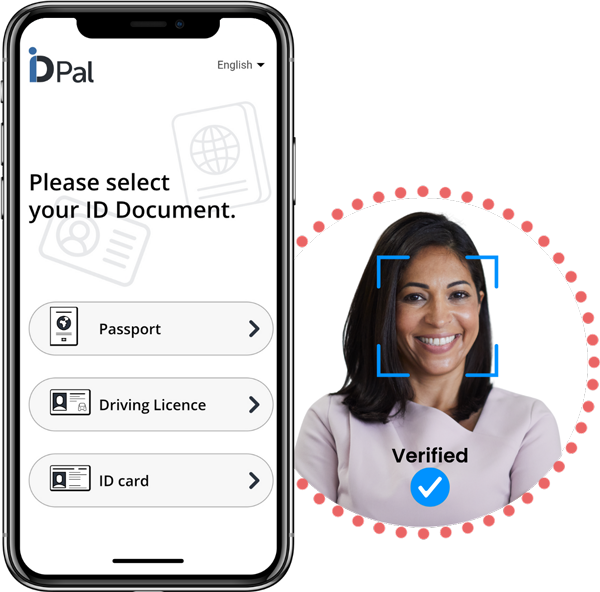

100% AI-Powered

Real-Time Verification

Zero Access to Customer Data

Discover more of ID-Pal’s technologies for identity verification and AML screening.