Industries

Payment providers, merchants, bank acquirers, PSPs, card schemes and regulators can seamlessly prevent fraud at source while ensuring effortless regulatory compliance.

The more verification layers present, the harder it is for fraudsters to win. Most importantly, the user journey is easy and friction-free.

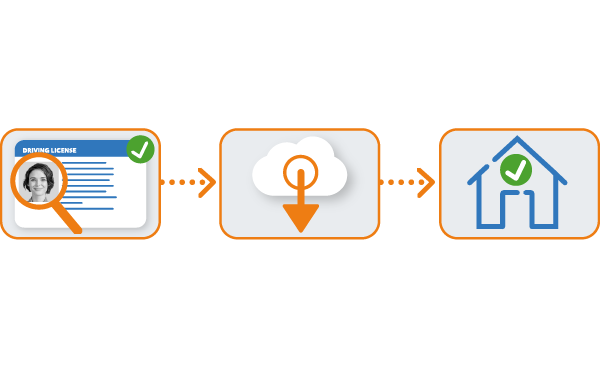

Verify the details submitted by an individual match their residential address. Gain confidence in the identity of your clients, members or customers.

Capture, verify and securely store data from any point of onboarding to align offline and digital channels. Simplify results with one clear, full Address Match.

Multi-Layered

Designed for seamless integration, our platform is 100% AI-powered for real-time identity verification and robust compliance, making it the perfect ally for payments providers aiming to enhance security, improve customer experience, and navigate the complexities of global regulations with ease.

Choose ID-Pal to not just meet, but exceed the demands of modern payment ecosystems.

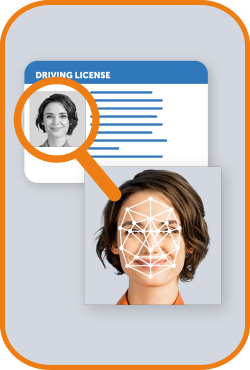

ID-Pal performs up to 70 technical checks per document, to ensure authenticity and confidently reject suspicious submissions. Our multi-layered identity verification process then verifies the facial image present.

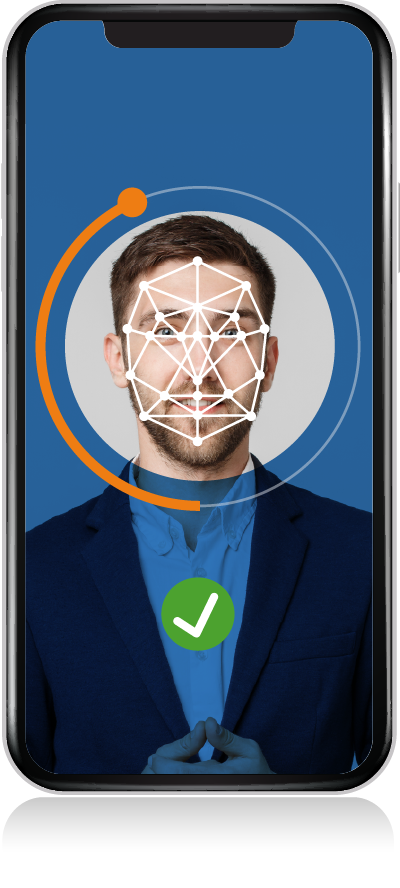

Unburden your team from the challenge of manual identity verification. Our cutting-edge facial matching technology instantly confirms that the face in a submitted ID matches the person present. A 50-point biometric facial comparison maps features as part of our identity verification process.

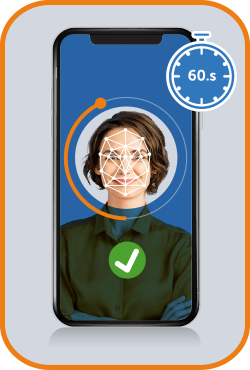

Liveness Checks confirm a real, live person is completing your identity verification process. ID-Pal Liveness Testing instantly assesses micro-variations in fraudulent techniques. This is why our Liveness Testing technology is independently certified to prevent the latest presentation attacks.

Reduce customer onboarding times with Address E-Verification. ID-Pal verifies an individual’s Name and Address against multiple databases during onboarding, ensuring one clear Full Address Match & removing the need for Proof of Address.

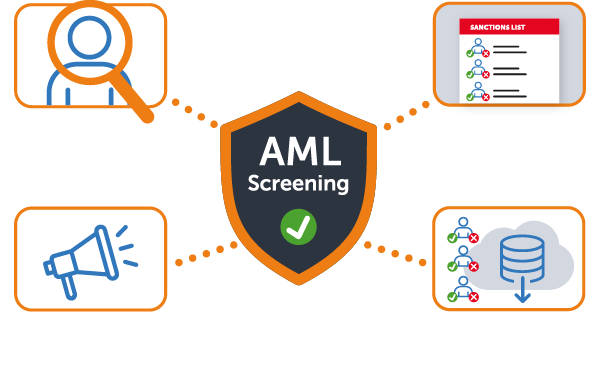

Add an additional layer of fraud prevention to your plan. Screen individuals in real-time against global PEPs and Sanctions lists. Perform Adverse Media checks across live sources and easily enroll individuals for periodic risk screening and Ongoing Monitoring.

Add-On Feature (additional cost)

Explore the additional features available that simplify compliance and offer robust fraud prevention.

This add-on feature enhances document verification and accuracy rates on each submission for the three most common types of document fraud attacks.

Match a customer’s validated data against over 160+ trusted data sources to verify an address in real-time automatically, as an additional verification and fraud prevention layer.

Screen individuals in real-time against global PEPs and Sanctions lists. Perform Adverse Media checks across live sources and easily enroll individuals for periodic risk screening and Ongoing Monitoring.

Have more questions? We’re here to help! Get in touch to find out more about our Identity Verification solutions.

Identity verification is a cornerstone for payment providers and merchants in safeguarding transactions and enhancing customer trust. It mitigates the risk of fraudulent transactions by ensuring that customers are who they claim to be. For payment providers and merchants, implementing robust identity verification processes means:

Our identity verification solution is designed for seamless integration across various platforms used by merchants, payment providers, bank acquirers, PSPs, and card schemes.

Our solution features robust integration options: out-of-the-box, API or SDK or via our Salesforce Integration. This ensures compatibility with existing systems, facilitating smooth onboarding and transaction processes without disrupting user experience.

We understand the diverse needs of bank acquirers, PSPs, and card schemes. Our platform offers customisable verification flows, allowing you to tailor the verification process to match your specific operational requirements and risk profiles.

As your business expands, our solution grows with you. It’s designed to handle increased verification volumes effortlessly, ensuring you can scale your operations while maintaining high security and compliance standards.

For payment providers, identity verification is instrumental in enforcing and adhering to AML compliance. Firms should have comprehensive AML Screening checks against global databases, PEP lists, and sanctions lists, ensuring thorough background screening in line with AML regulatory requirements.

ID-Pal provides real-time identity verification, enabling quick detection of fraudulent documents. It facilitates easy reporting to regulatory bodies through an automated audit trail, ensuring compliance and aiding in the prevention of money laundering activities.

Our platform assists payment providers in assessing and managing risks associated with money laundering, helping them implement more effective AML strategies.

USA

Ireland

United Kingdom

USA

USA

Ireland

UK

USA

Copyright © 2025 ID-Pal. All rights reserved.