Industries

Insurance companies and brokers can streamline and automate identity verification with ID-Pal.

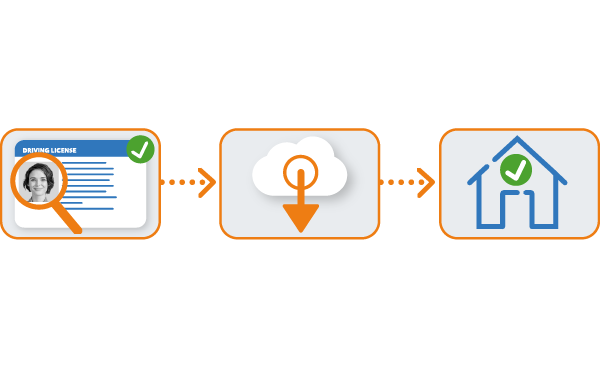

Onboard customers in-person or remotely on any device. The journey can be completed via web or mobile app, with an automatic audit trail generated.

By offering a journey that is fast and efficient, customers are onboarded sooner. Smart decisioning and automated workflows allow you to design a custom journey for exceptional cases.

The solution is ideal for multi-office or broker model when approval is needed from multiple parties and high-volume customer onboarding. Head office verifies and approves in seconds.

Multi-Layered

Designed for seamless integration, ID-Pal is the ideal identity verification solution for insurance firms and brokers looking for an out-of-the-box option that is compliant with AML and KYC regulation, automates their audit trail and enhances overall data security and fraud prevention across their organisation.

The platform can be adjusted in seconds, using its omni-channel build. From online onboarding to in-person, backbook remediation to deploying a multi-office model or broker model, talk to our team about the solution you need.

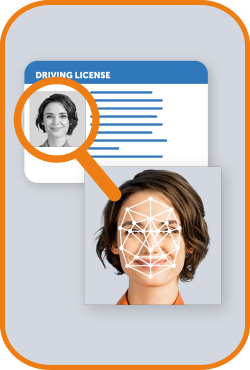

ID-Pal performs up to 70 technical checks per document, to ensure authenticity and confidently reject suspicious submissions. Our multi-layered identity verification process then verifies the facial image present.

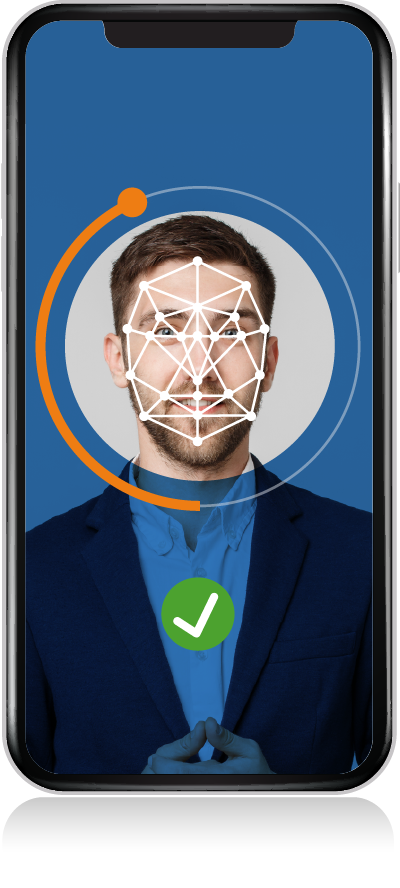

Unburden your team from the challenge of manual identity verification. Our cutting-edge facial matching technology instantly confirms that the face in a submitted ID matches the person present. A 50-point biometric facial comparison maps features as part of our identity verification process.

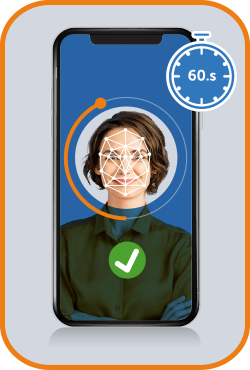

Liveness Checks confirm a real, live person is completing your identity verification process. ID-Pal Liveness Testing instantly assesses micro-variations in fraudulent techniques. This is why our Liveness Testing technology is independently certified to prevent the latest presentation attacks.

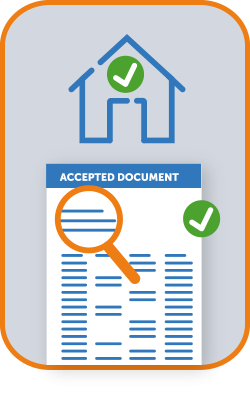

Reduce customer onboarding times with Address E-Verification. ID-Pal verifies an individual’s Name and Address against multiple databases during onboarding, ensuring one clear Full Address Match & removing the need for Proof of Address.

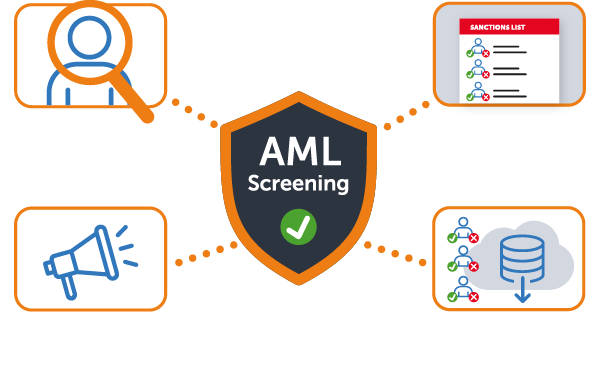

Add an additional layer of fraud prevention to your plan. Screen individuals in real-time against global PEPs and Sanctions lists. Perform Adverse Media checks across live sources and easily enroll individuals for periodic risk screening and Ongoing Monitoring.

Add-On Feature (additional cost)

Explore the additional features available that simplify compliance and offer robust fraud prevention.

This add-on feature enhances document verification and accuracy rates on each submission for the three most common types of document fraud attacks.

Match a customer’s validated data against over 160+ trusted data sources to verify an address in real-time automatically, as an additional verification and fraud prevention layer.

Screen individuals in real-time against global PEPs and Sanctions lists. Perform Adverse Media checks across live sources and easily enroll individuals for periodic risk screening and Ongoing Monitoring.

Have more questions? We’re here to help! Get in touch to find out more about our Identity Verification solutions.

Identity verification is critical for insurance companies and brokers for fraud prevention, regulatory compliance, and customer trust.

By accurately verifying the identities of policy applicants and claimants, insurers can significantly reduce the risk of fraudulent claims and identity theft. This process not only safeguards the company’s assets but also ensures adherence to stringent industry regulations, meeting KYC (Know Your Customer) and anti-money laundering (AML) requirements. Moreover, implementing a robust identity verification system enhances the customer onboarding experience, providing a seamless and secure process that builds client confidence.

In an era where digital onboarding and working online with a company are the norm, offering a reliable verification method positions your company as a trustworthy and forward-thinking entity in the insurance market.

ID-Pal is tailored specifically for the unique needs of the insurance sector, offering simple, secure and convenient identity verification. We understand the challenges insurance companies and brokers face, including the need for customer due diligence and robust compliance with evolving regulatory requirements.

Our solution leverages advanced technologies, such as artificial intelligence (AI) and biometric verification, to provide real-time identity verification. This enables insurers to quickly validate customer identities with high accuracy, reducing the risk of fraud and streamlining the claims process. Applicants gets decisions right away on, which eases up the operational demands for your team and makes onboarding faster. Additionally, our system is designed to be easily integrated into existing workflows especially via our out-of-the-box solution or our Salesforce integration.

With our customisable platform, you can adjust verification steps to your specific compliance needs across different jurisdictions, ensuring you adhere quickly to any new changes without increasing demands on operational efficiency.

Compliance with regulatory standards is a major challenge and concern for insurance companies and brokers, given the ever-changing legal landscape. A digital identity verification solution streamlines compliance by being able to incorporate in real-time any updates on regulatory changes. Platforms like ID-Pal are dynamic and can plug in necessary technology and changes needed with ease, compared to legacy vendors that are built to be static.

By utilising an AI-powered identity verification solution, insurers ensure that their operations remain in line with the latest KYC, AML, and other relevant regulations, without the need for constant manual oversight. Our platform can perform AML Screening checks, including PEPs and Sanctions screenings, Adverse Media checks and Ongoing Monitoring of individuals, taking this off the list of actions your team need to do. Furthermore, we offer automated reporting for customer due diligence, making it easier for insurance entities to provide evidence of compliance during audits or regulatory reviews.

By simplifying the compliance process, our solution allows insurance companies and brokers to focus more on their core business activities, confident in their adherence to legal obligations.

USA

Ireland

United Kingdom

USA

USA

Ireland

UK

USA

Copyright © 2025 ID-Pal. All rights reserved.