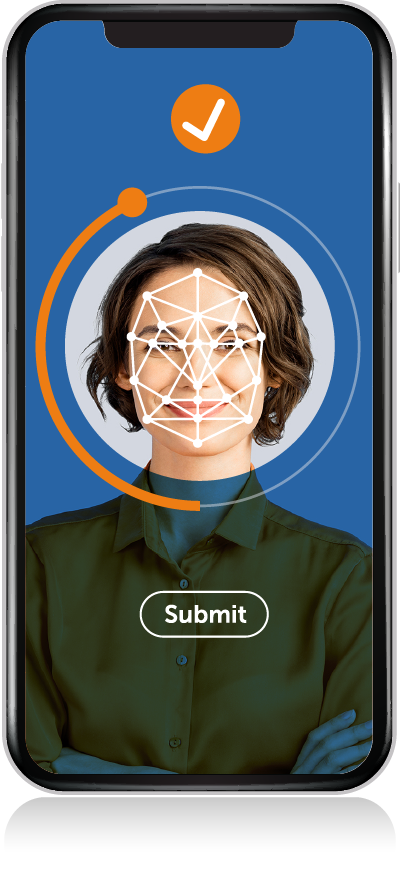

Our ID verification solution uses 100% AI-powered technology to deliver seamless customer onboarding and robust compliance.

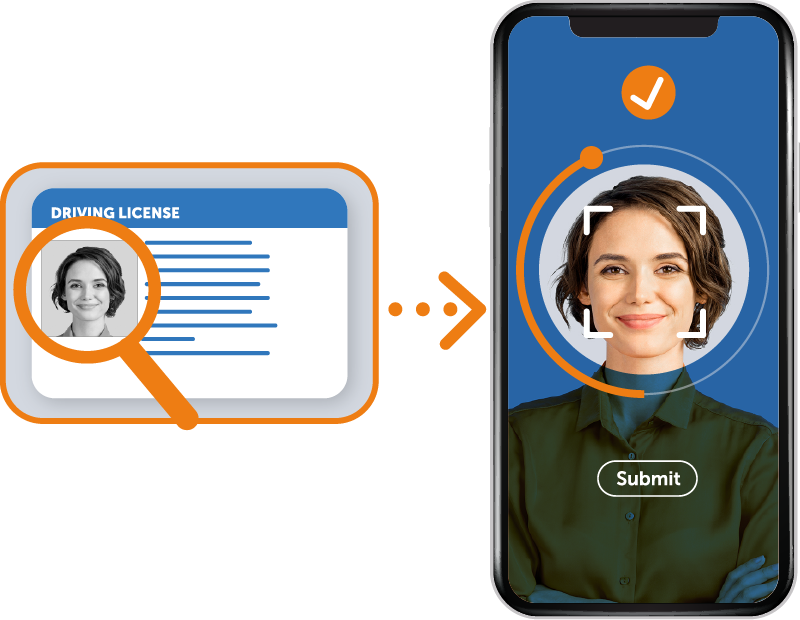

1. Customer captures and submits ID information in seconds.

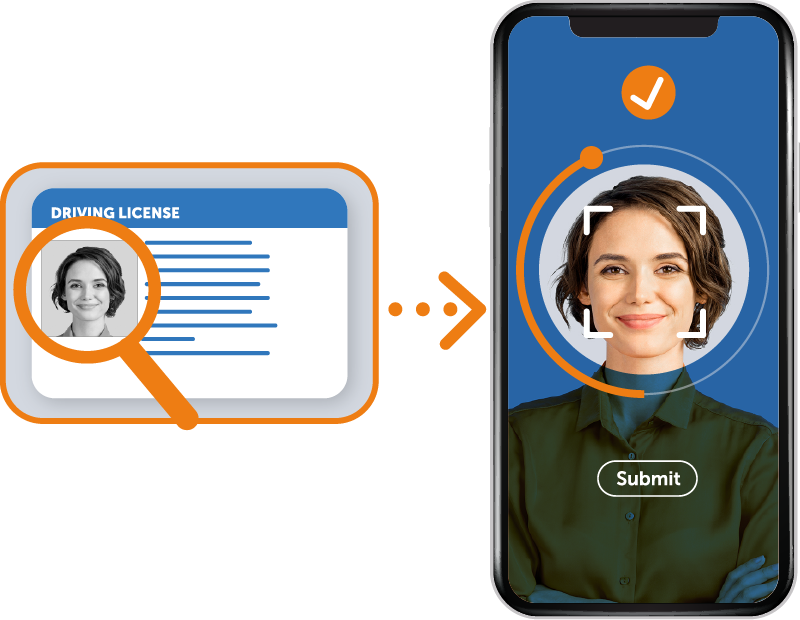

2. Documentation subjected to rigorous technical checks.

4. Client Due Diligence Report generated for secure storage and instant audit trail.

1. Customer captures and submits ID information in seconds.

2. Documentation subjected to rigorous technical checks.

4. Client Due Diligence Report generated for secure storage and instant audit trail.

You send a link via SMS or email to your customer to initiate the Identity Verification process.

Your customer receives the link to start the identity verification process and upload documents requested.

Our solution conducts database-matching by extracting the name and address shown in the documents to verify their identity and address. We prove the customer currently lives there.

Using Address E-Verification eliminates the need for a separate Proof of Address document, making the process quicker to complete.

ID-Pal is the easiest way for businesses to meet AML requirements in a simple, secure and convenient way. With compliance built in, your business can enjoy real-time verification of customers across the globe.

A Client Due Diligence report is automatically generated per submission and securely stored, providing a robust audit trail.

From digital ID checks to AML screening, we simplify the process via an award-winning user experience.

Configure the journey to your business needs with no technical effort and avoid costly development projects.

Have more questions? We’re here to help! Get in touch to find out more about our Identity Verification solutions.

Our solution is ‘turnkey’—ready to use right out of the box, with no complex assembly or convoluted setup required. It’s designed for immediate implementation, offering a straightforward, hassle-free experience without the need for extensive and costly development projects for your business.

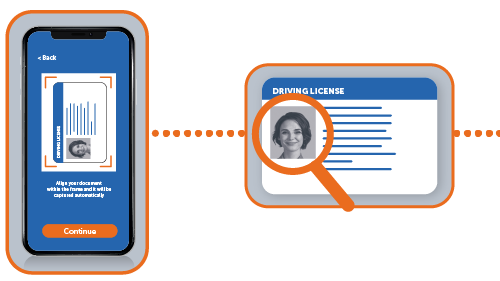

Our API and SDK enable a seamless connection to your current systems, allowing for a smooth implementation process without disrupting your operations. Our out-of-the-box integration is ready to use, just toggle on the features you need and design the journey you want in minutes.

Legacy vendors often give you building blocks that need to be connected together to function. With ID-Pal the perfect solution is already built.

Discover more of ID-Pal’s technologies for identity verification and AML screening.

USA

Ireland

United Kingdom

USA

USA

Ireland

UK

USA

Copyright © 2025 ID-Pal. All rights reserved.