Prevent identity document fraud and deliver reliable verification results that support faster onboarding and stronger regulatory compliance.

Detect and prevent document fraud

Coverage across 16,000+ identity documents

Save time through reduced manual checks

Have confidence in submitted ID documents with a secure combination of automated biometric, document and database checks.

Save money through prevented fraud – our AI-powered checks are designed to detect even the most sophisticated fraud attempts.

Speed up customer onboarding and reduce manual input with a fully automated, real-time identity verification flow.

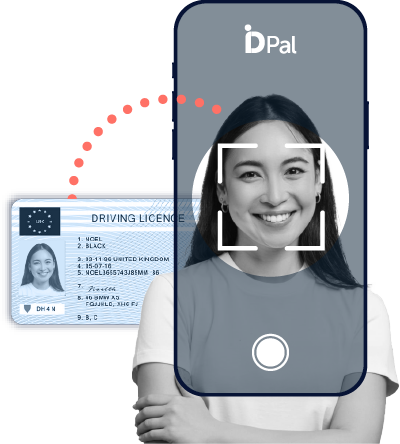

Identity document verification is the process of confirming that a government-issued ID (such as a passport, national ID card, or driving licence) is genuine, valid, and belongs to the person presenting it.

Our approach combines automated checks – document authenticity, security features and data consistency – with biometric matching (for example, comparing the ID photo to a live selfie) and database checks to confirm a document is real.

Our combination of automated biometric, database and document checks can detect even the most sophisticated fraud attempts with more than 99% accuracy. Speed up onboarding and block fraud at source with automated, AI-powered document checks.

ID-Pal detects forged, altered, and reused identity documents using automated checks. This reduces reliance on manual review and closes common gaps exploited by document fraud, preventing fraud losses.

ID-Pal supports KYC, KYB and AML requirements across multiple jurisdictions. Audit trails, consent handling, and configurable workflows make it suitable for regulated industries without adding costs.

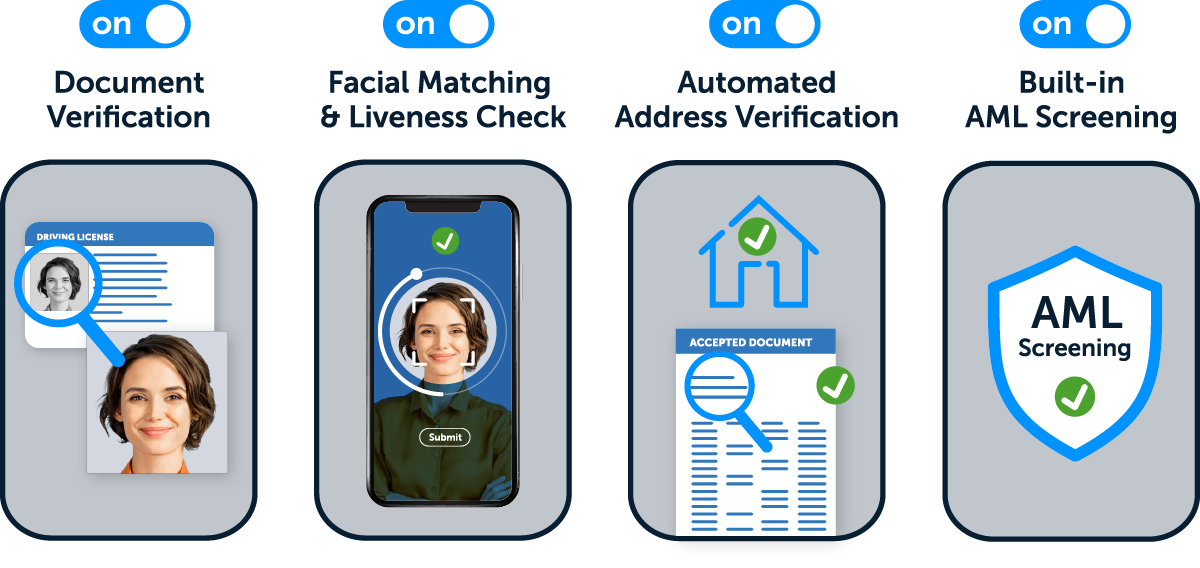

Our out-of-the-box solution is fully flexible and customisable, and can be deployed in just a single day. No coding, no complex integrations – tailor the verification flow to your requirements with just one click.

Fully automated, multi-layered checks and high success rates means manual reviews and follow-ups are reduced, freeing up your onboarding teams to focus on higher-value activity with confidence.

Research has shown that screen recapture, photocopy and portrait substitution are present in 90% of all attempted document fraud attacks. ID-Pal uses a combination of checks to ensure document authenticity and is effective in detecting a wide range of fraud attempts.

A digital reproduction of an identity document made using a device such as a mobile, tablet, computer, or monitor.

Our platform is powered by AI, with the ability to detect up to 99% of fraudulent documents using our ID-Detect feature.* Perform enhanced verification checks on every identity document to confirm that it is genuine.

*Attack presentation classification error rate results testing Photocopy & Printed image <1%

Have questions about how our platform works, or want to book a demo? We’re here to help! Get in touch to find out more about our identity verification solutions.

100% AI-powered document checks

Real-time user verification

Detect and prevent fraud at source

Explore a range of identity verification solutions designed to meet your AML, KYC and KYB compliance needs. From real-time ID verification to address e-verification, we offer tailored, industry-leading tools for easy onboarding and robust compliance.

Identity Document Verification confirms the authenticity of an individual’s identification documents, such as passports, driver’s licenses, or national ID cards. This verification process is essential in financial services to prevent fraud and ensure compliance with regulatory requirements.

The verification process typically involves several steps:

Identity document verification is crucial for businesses for several reasons:

Yes, our identity document verification solution is designed to be flexible and easily integrated into existing systems.

We offer an out-of-the-box option and also offer an API (Application Programming Interfaces) and SDK (Software Development Kits) that enables seamless integration with a business’s current digital infrastructure, including customer onboarding platforms, ecommerce websites, and mobile applications.

This integration capability allows your business to add ID-Pal without disrupting the user experience or requiring significant transformation projects to integrate ID-Pal with their existing processes.

Additionally, we offer customisable features, allowing your firm to tailor the process to their compliance requirements.

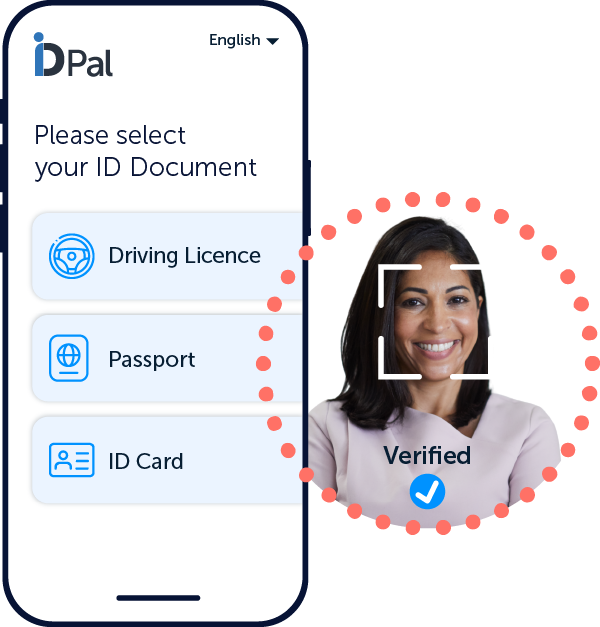

Most modern document verification solutions support passports, national ID cards, residence permits, and driving licences.

ID-Pal can verify documents in 250+ jurisdictions globally, enabling businesses to onboard users anywhere in the world while staying compliant with local regulations.

Identity document verification reduces fraud by detecting forged, altered, or stolen documents and ensuring the document holder is physically present. Advanced solutions such as ID-Pal combine document checks with liveness detection and biometric matching to prevent impersonation attempts, deepfakes, and synthetic identity fraud.