ID-Pal Database Checks offer a single access point to 160+ Data Sources across countries all over the world.

ID-Pal covers more than 7000+ Identity Documents from across more than 200+ jurisdictions.

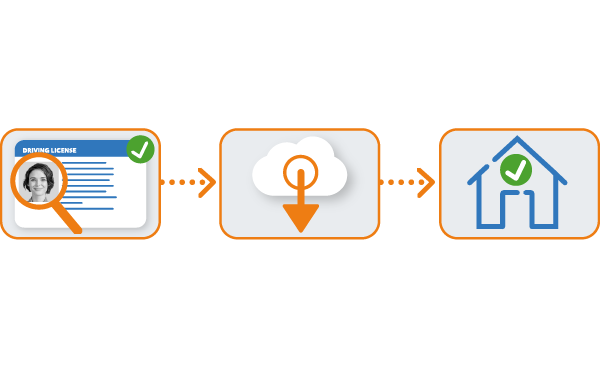

Address Checking captures address details and matches these against a set of databases.

Once Address Database Checking is activated, a screen in your review flow produces instant results of database checks. All results of the matches and the databases used are shown in your Customer Due Diligence report.

Indicates that there was a Full Match for 1+1 Verification returned from the database checks. (i.e. a name and address was matched against one or more database sources).

Selecting the result will provide details on the database results, including:

(a) which information matched/did not match.

(b) which databases were used.

In Address Database Matching, the name and address provided by the customer confirm that they are who they claim they are – further strengthening a business’s protection from fraud. When no match is returned from the database checks, your team can decide the best course of action and customise your process to take next steps based on your requirements.

Improve the degree of fraud protection for your business, whilst making the onboarding process even simpler for your customers.

Explore more solutions that simplify online identity verification and fraud prevention.

This add-on feature enhances document authenticity and accuracy rates on each submission via checks for document fraud.

Match against over 160+ trusted data sources to verify an address in real-time, as an additional layer of fraud prevention.

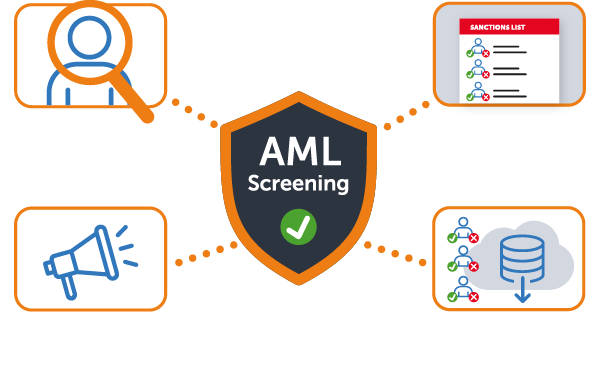

Instantly screen individuals against global sanctions lists. Perform adverse media checks across live sources. Enroll in ongoing checks.

Have more questions? We’re here to help! Get in touch to find out more about our Identity Verification solutions.

Address database checking is a critical component of identity verification services. It involves cross-referencing an individual’s provided address against a comprehensive and up-to-date database of addresses. This process helps in confirming the authenticity of the address details provided by a user. By ensuring that the address exists and matches the details given by the individual, businesses can prevent fraud, enhance customer trust, and comply with regulatory requirements. Our solution accesses a wide range of authoritative databases, providing real-time verification to support the integrity of your verification processes.

For example, AML regulations require that banks and other financial institutions that issue a credit or allow customers to open deposit accounts follow rules to ensure they are not aiding in money-laundering.

Absolutely, and positively so. Our address database checking service is designed with both security and customer experience in mind. By automating and streamlining the verification process, it minimises the need for manual input and document submission, reducing friction and improving the speed of onboarding and transactions. Customers appreciate the ease with which their addresses are verified, enhancing their trust in your services. Furthermore, our solution is built to seamlessly integrate into your existing platforms, ensuring a seamless verification process that supports rather than hinders the customer journey.

Discover more of ID-Pal’s technologies for identity verification and AML screening.

USA

Ireland

United Kingdom

USA

USA

Ireland

UK

USA

Copyright © 2025 ID-Pal. All rights reserved.