Transform a complex process into a streamlined and efficient practice, ensuring easy AML compliance with legislation in any jurisdiction.

Our online ID verification solutions are the easiest way for businesses to meet AML requirements. With compliance built in, organisations enjoy real-time verification of customers across the globe.

Digital identity verification for seamless AML compliance.

Verify the details submitted by an individual match their residential address. Gain confidence in the identity of your clients, members or customers.

Covering 7000+ Identity Documents from across 200+ jurisdictions, enjoy enhanced verification using 160+ trusted data sources.

A Client Due Diligence report is automatically generated per submission and securely stored, providing a full audit trail.

Customise the solution to be compliant with AML per jurisdiction or profile. No lengthy deployment, toggle on/off requirements.

Fraudsters exploit weaknesses in compliance processes. Secure all channels and reduce the risk of fraud.

Have more questions? We’re here to help! Get in touch to find out more about our Identity Verification solutions.

AML (Anti-Money Laundering) Compliance refers to the set of laws, regulations, and procedures designed to prevent individuals and entities from disguising illegally obtained funds as legitimate income. Essential for maintaining the integrity of the global financial system, AML compliance helps deter criminal activities by requiring financial institutions and other regulated entities to monitor customer behavior, conduct due diligence, and report suspicious activities.

For businesses, adhering to AML regulations is crucial not only for preventing financial crime but also for avoiding hefty penalties from non-compliance. It protects the reputation of institutions, enhances investor confidence, and ensures the stability and transparency of financial markets. Implementing robust AML measures allows organizations to detect and prevent money laundering and terrorism financing activities effectively, fostering a secure and trustworthy business environment.

An effective AML compliance program comprises several key components, designed to enforce compliance and mitigate risks:

These components are crucial for creating a comprehensive AML strategy that not only complies with regulatory requirements but also proactively protects the institution from money laundering threats.

Technology has significantly transformed anti-money laundering (AML) compliance by introducing sophisticated tools that automate and enhance the effectiveness of compliance processes.

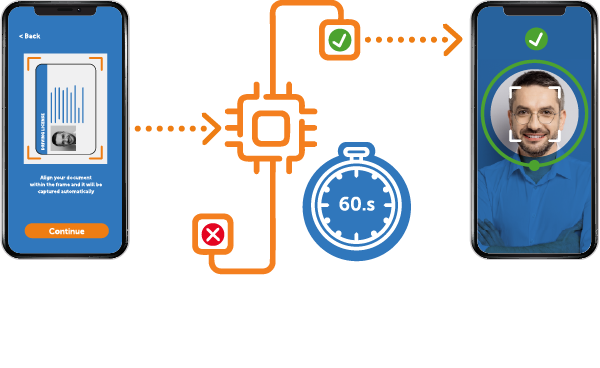

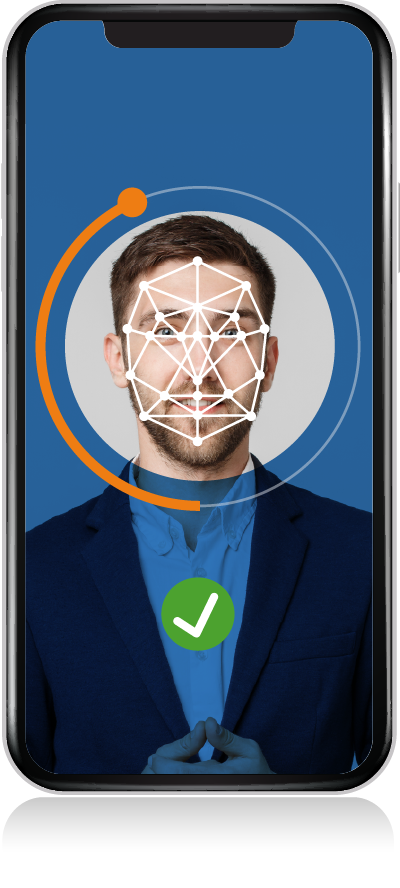

Artificial Intelligence used in identity verification improves the efficiency and accuracy of fraud detection, allowing for the identification of fraudulent actors committing money laundering.

Identity verification platforms streamline AML compliance processes, offering dynamic risk assessment, efficient reporting tools, and automation of customer due diligence (CDD) reporting.

By leveraging these technologies, firms strengthen their AML compliance programs, ensuring more robust protection against financial crime while optimising operational efficiency.

Discover more solutions that offer simple, secure and convenient AML compliance.

USA

Ireland

United Kingdom

USA

USA

Ireland

UK

USA

Copyright © 2025 ID-Pal. All rights reserved.